After the crisis, an opportunity for small cap companies?

The decline in equity markets caused by the spread of Covid-19 was brutal in both its speed and magnitude. Thus, the week of March 9 will go down in stock market history as one of the worst weeks ever.

Around the world, government reactions to this health crisis were drastic. In order to avoid congestion in the health system, many countries literally shut down their economies and confined their populations. The impact on the economy, both nationally and internationally, has been significant: air traffic reduced by 95%, deserted city centres, closed shops and restaurants, interrupted supply chains and shut down production sites. Unsurprisingly, economic institutes such as the IMF and ECB predict a strong global recession in 2020.

Nevertheless, every crisis has an end, and the right conclusions will have to be drawn at various levels, including the financial markets. This also applies to Europe's small caps.

How do small-cap stocks behave during market downturns?

First, let's analyse how small caps have behaved since the beginning of the current crisis?

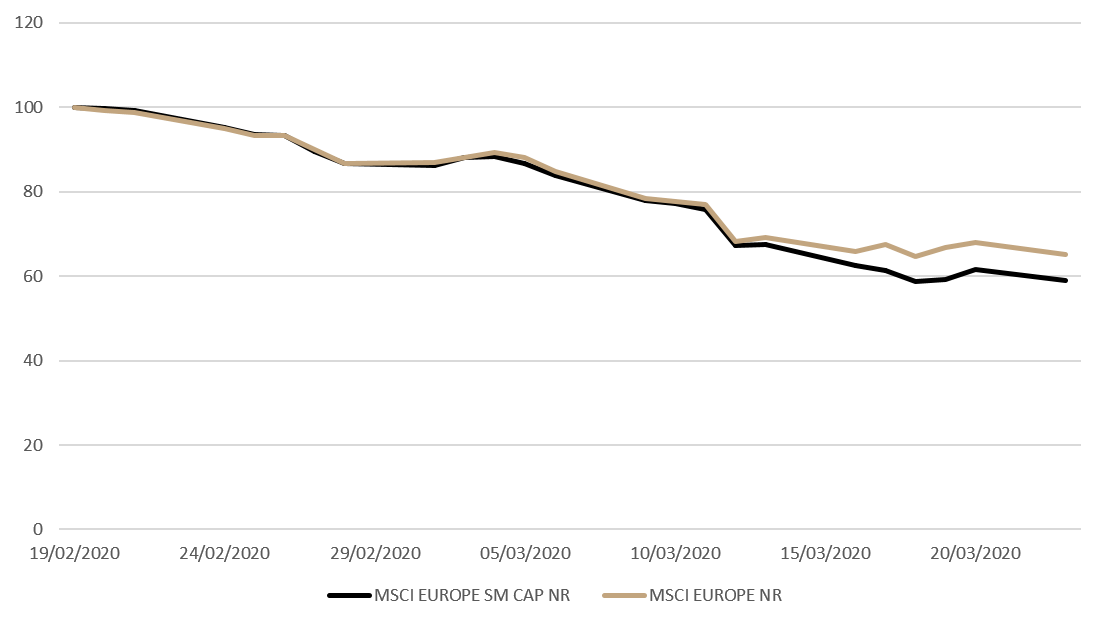

From this year's high (19/02/2020) to its low (23/03/2020), the MSCI Europe Small Cap NR Index has depreciated by 41%, a more pronounced decline than that of the MSCI Europe NR, its "Large Cap" equivalent, which has dropped by 35% (see graph).

Source: MSCI, Bloomberg

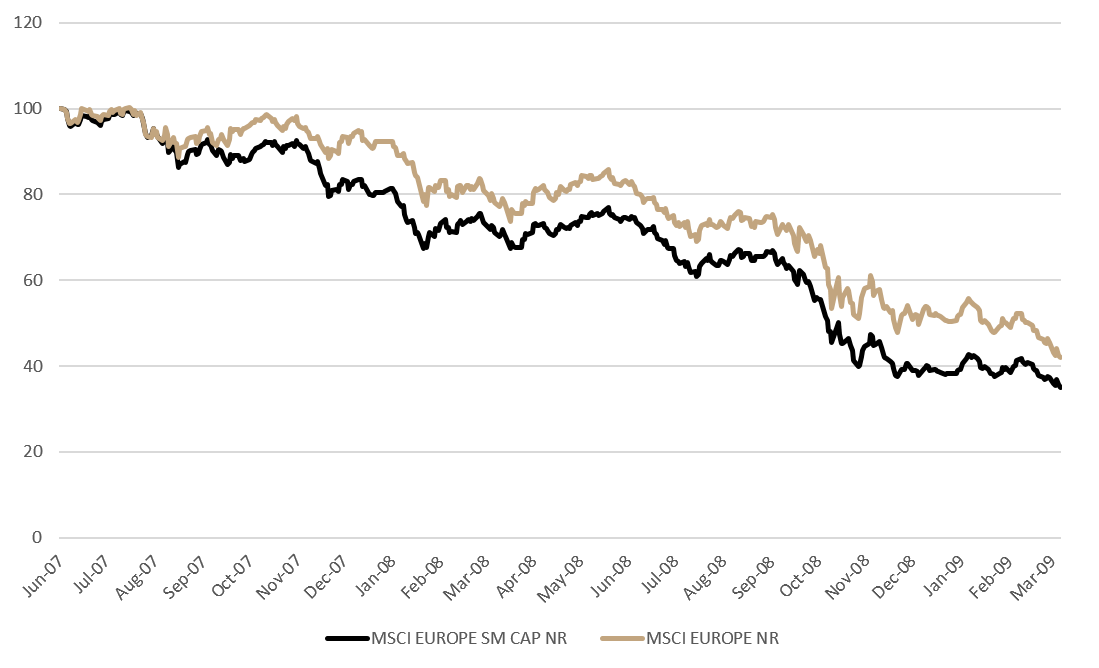

This tendency for small caps to decline more sharply than large caps was also observed during the financial crisis of 2007-2008, as shown in the chart below.

Source: MSCI, Bloomberg

The underperformance of small-cap stocks during a market correction is mainly due to two factors:

- Firstly, in times of uncertainty or crisis (health, economic or financial), the main objective of investors is to preserve their capital. Small companies, which are often active in niche or very specific sectors, generally do not have the capacity to compensate for the decline in demand in one division by the stability of another division. In other words, investors, looking for visibility and stability, prefer to invest in large and diversified companies such as Nestlé, Unilever or Roche rather than to be exposed to a small Italian company active in a single sector.

- The second reason is of a technical nature. The liquidity of small-cap companies in terms of securities traded on the market is more limited than that of large-cap companies. Often, a reference shareholder who, in general, does not frequently change his position holds part of the company. Thus, when the market is down and everyone wants to sell, the stock prices of these companies suffer more.

After the lows, the quest for the top?

Once this underperformance has been established, what useful conclusions can we draw from it? Let's look at what happened during the last two decades, and more specifically at the behaviour of the small-cap segment just after major stock market crises.

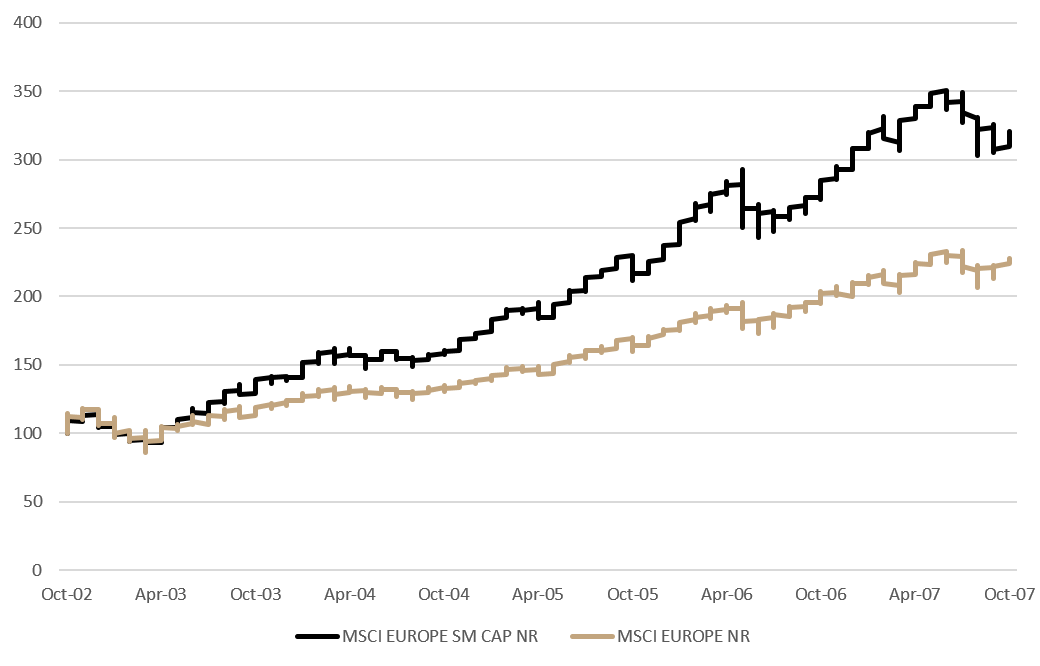

Thus, in the early 2000s, after the dot-com bubble burst, small caps outperformed large caps in the five years following the market low of October 9, 2002.

Source: MSCI, Bloomberg

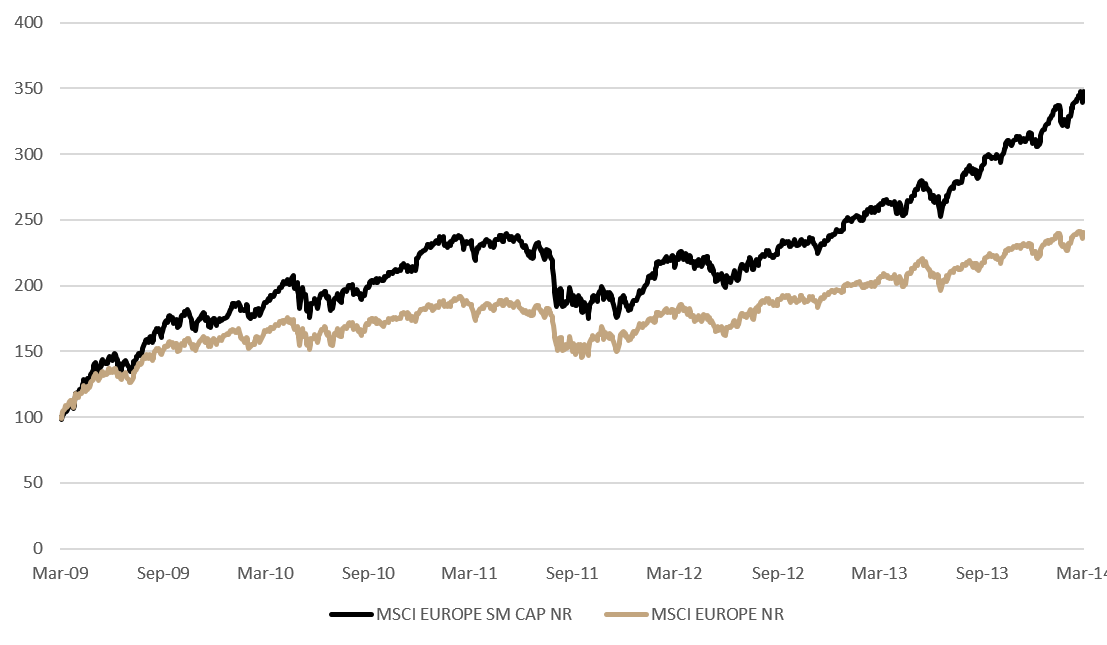

The same conclusion can be drawn from the analysis of the evolution of European stock markets after the financial crisis triggered by the failure of the investment bank Lehman Brothers. After reaching a low point on 6 March 2009, the market recovery over the next five years proved to be more pronounced for small companies than for large ones.

Source: MSCI, Bloomberg

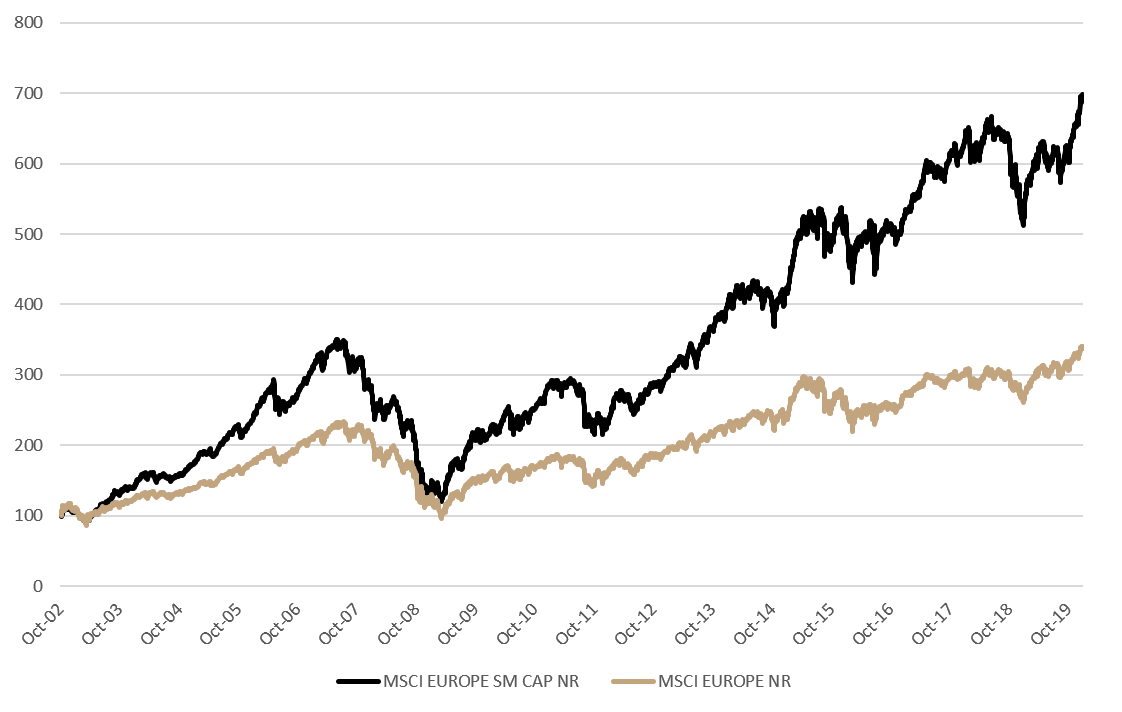

Over a longer time horizon encompassing these two crises (9/10/2002-31/12/2019), this difference is even more noticeable. Thus, despite the sharp underperformance of small caps at the height of the 2008 global financial crisis, the outperformance of small caps over the entire observation period remains particularly obvious.

Source: MSCI, Bloomberg

Will history repeat itself?

While it is impossible to be certain, we are convinced that, once again, many small-cap stocks should emerge stronger from this crisis.

In fact, small cap companies generally benefit from specific characteristics that favour them in periods of economic and stock market recovery:

- Strong balance sheets: small companies do not have the same ability as large companies to finance themselves with debt; they therefore have a more conservative financing policy and lower debt levels that allow them to quickly restart their activities after an economic recession. For example, the MSCI Europe Small Cap's 2019 Total Debt/Equity ratio is 1.24x while the MSCI Europe Small Cap ratio is 1.63x.

- A generally flatter hierarchical organisation that gives smaller companies more agility, allowing them to adapt more easily to market changes.

- Smaller companies are usually in a phase of their development characterized by a stronger growth, which is an attractive feature for investors.

- Small-cap companies often have very specific know-how and focus on a limited number of products or services that require little recovery time.

- The problem of liquidity, which penalized them so much in a downturn, plays the opposite role in an upturn since it favours the development of the share price.

In conclusion, all these factors argue in favour of a return to popularity for small-cap stocks, once calm has returned to the financial markets. It is however essential, in order to generate sustainable performance over the long term, to maintain a high degree of selectivity in the choice of individual stocks and to only invest in companies that are solid enough to withstand periods of recession.

It is this objective that BLI's disciplined investment methodology aims to achieve by focusing on high-quality companies with strong competitive advantages, solid balance sheets, unique expertise and high potential for cash flow generation.