Covid-19: how will it affect the economy and what is the best investment approach?

As we are in the midst of a public health crisis on a scale not seen for over a century, we felt it was important to provide an assessment of the current macroeconomic context.

What are the macroeconomic consequences of the public health crisis?

The panic currently gripping financial markets is largely due to the surge in the number of people infected with coronavirus and the economic consequences of the essential lockdowns imposed by governments in Europe and the USA.

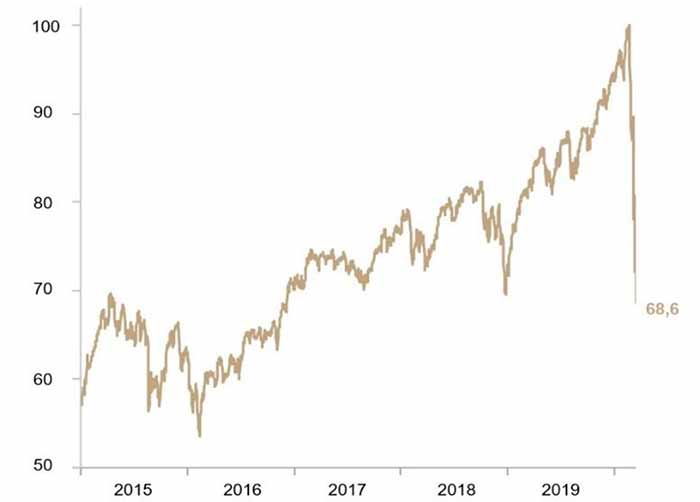

The global stock market has now plunged over 30% since its high point on 19 February – an exceptional selloff in such a short space of time.

GLOBAL STOCK MARKET IN EUR

100 = 19/02/2020, market peak

Source: Refinitiv Datastream, Banque de Luxembourg - 16/03/2020

While the number of new infections seems to be slowing sharply in Asia (the first continent to be affected by the crisis), unfortunately the same cannot be said for Europe or the USA. In these circumstances, the decision taken by the authorities in many European countries to close schools and non-essential businesses seems entirely justified. Social distancing is vital in order to slow the spread of the pandemic and isolation measures are being gradually adopted in the United States.

We are not in a position to make precise forecasts at present, but it is clear that the economic cost of shutting down the means of production and imposing quarantines will be substantial. These measures aimed at slowing business activity should ensure that the epidemic peaks more quickly and reduce the total number of people infected. The peak infection level, which has served as a good indicator of the equity market low-water mark in previous pandemics, is not yet in sight.

The response from the authorities

The various authorities have mobilised resources and are attempting to ensure a coordinated response to this crisis, through lockdowns (Europe and the USA) to limit the spread of the virus, fiscal loosening (China, Germany, France, etc.) and monetary easing measures (rate cuts, additional new asset purchases, massive injections of liquidity, easing of banking regulations, etc.). All of these measures are aimed at avoiding excessive damage to the economy and ensuring the effective functioning of capital markets and the banking sector.