How do we incorporate ESG factors into our discretionary management portfolios?

If you want to know more about how we incorporate ESG factors into our portfolios, please click on the different types of mandate:

1. Introduction and scope

Taking sustainability factors into account is nothing new at Banque de Luxembourg. Having specialised in asset management since the earliest days of the company, we believe in a responsible approach, focused on the long term, in which understanding and managing risk are of paramount importance. As such, and in a constant effort to improve, this policy will evolve.

This policy applies to all activities relating to management and the provision of private banking advice by Banque de Luxembourg, including its branch, Banque de Luxembourg Belgique (jointly “Banque de Luxembourg”).

Article 2 SFDR 1 defines a sustainability risk as “an environmental, social or governance (ESG) event or condition that, if it occurs, could cause a material negative impact on the value of the investment”, irrespective of whether that impact is actual or potential.

The consideration and assessment of sustainability risks are fully integrated into our investment strategy and processes, notably through the application of our sector exclusion policies, analysis of controversies and compliance with international conventions, integration of ESG data as well as through our Engagement policy 2.

Our ESG research draws on various external data sources. In particular, the quantitative ESG rating system used in the investment process is based on ESG ratings issued by the MSCI ESG Manager platform.

2. Governance

The Socially Responsible Investment Committee (“SRI”) operating within Private Banking Investments (“PBI”), which is responsible within the Bank for considering and assessing sustainability risks, comprises all members of the Discretionary & Advisory Management team, the Risk & Project Manager, the Head of Private Banking Investments, as well as the Head of Private Banking Investments. In addition, the committee includes the Corporate Social Responsibility (“CSR”) coordinator as an invited member.

The SRI meets once every month and has decision making power in relation to the monitoring of controversies, sector policies and any other ESG issue relating to investment. The alignments of model portfolios in terms of the cover ratio and the ratings provided by the MSCI ESG Manager module 3 are also discussed within the SRI committee.

3. Exclusion policies

3.1. Sector policies

The Bank adjusts its sector policies on an ongoing basis in line with the principles established by its shareholder, Crédit Mutuel Alliance Fédérale group. Accordingly, one of the strong commitments under sector policies concerns the framework for investment activities in sectors exposed to significant environmental and social risks. More specifically, the following are affected:

– Companies involved in the controversial weapons industry, such as anti-personnel mines, cluster munitions, depleted uranium and white phosphorus munitions, as well as chemical and biological weapons;

– Companies involved in the coal power station industry that have been included in the Global Coal Exit List, a list which is updated annually by the NGO Urgewald 4.

This list is not exhaustive and may be expanded in future.

3.2. Compliance with international agreements

Failure to comply with the UN Global Compact is another ground for exclusion. The UN Global Compact is a United Nations initiative aiming to encourage businesses and firms worldwide to adopt socially responsible policies by committing to incorporate and promote various principles relating to human rights, international labour standards, the environment and anti-corruption.

Companies involved in any controversy or controversies associated with the failure to comply with the UN Global Compact are excluded from our investment universe 5.

4. Analysing controversies

Candidates for investment and companies held in the portfolio are subject to constant monitoring to identify noteworthy ESG events that could affect the company’s business model, its reputation and potentially therefore the Bank’s investment case. Our team thus receives daily alerts via the MSCI ESG Manager platform for all notable controversies to which portfolio companies are subject.

The filter is initially based on the classification of controversies allocated by MSCI based on the degree of severity (minor moderate, severe and very severe). For external funds, controversies monitoring is carried out by fund managers in accordance with their investment policies. However, we also monitor controversies via the MSCI ESG Manager platform and limit exposure to these very severe controversies to 5% of the funds held.

Assets exposed to a very severe controversy must be withdrawn from the Bank’s investment universe within three months of their change in status. Any asset classified as subject to a very severe controversy may no longer be proposed to our clients for investment.

With regard to assets held:

- on a discretionary management basis, these will be sold within three months. In certain exceptional cases, the relevant asset may be retained after in-depth analysis by the Bank and approval by the SRI committee;

- on an advisory basis, the client will be informed concerning any existing controversies in order to guide his/her decision making in the optimum manner.

5. Investment universe

The assets that make up our recommended investment universe are being gradually classified using a sustainability scale with a view to achieving complete coverage of our universe 6. For this, we rely on the analysis of the external data provider, MSCI 7.

In order to assess the ESG risks of a company, MSCI determines the main risks for the sector to which it belongs, then assesses its ability to manage the various ESG risks identified in comparison to its direct competitors. Companies which manage these risks best will be given a high score within their sector (best-in-class approach). This extra-financial approach compares companies within their individual business sector to determine those that are best positioned with regards to their understanding of the risks and opportunities related to sustainable development.

Furthermore, the implementation of sector policies (see section 3.1) and the analysis and monitoring of controversies allows us to ensure that the investments made comply with certain prerequisites that have been set to respond to the sustainability criteria defined by the Bank.

5.1. Individual securities

Individual securities are selected on the basis of the Bank’s fundamental approach and non-financial data is considered when assessing risks and opportunities. Accordingly, fundamental analysis is at the heart of the management process, allowing us to identify and quantify the strength of a company’s competitive advantage and assess its long-term potential.

This analysis of the company’s fundamentals is based on historical profitability levels, the strength of the balance sheet, capital allocation and the management team’s past decisions. Determining potential available cashflow generation and carrying out a detailed assessment of the company’s secular growth drivers are also key stages in the analysis process.

For our valuation model, we use a standardised Dividend Discount Model (DDM) across all the securities in our universe, regularly supplemented with Discounted Cash Flows (DCF) analysis allowing us to determine each company’s intrinsic value. Calculating this intrinsic value provides a point of reference so that we can avoid paying too much for a company. It also serves as a guide in the purchasing and selling process. This characteristic feature of our approach allows us to better understand the risks associated with an investment.

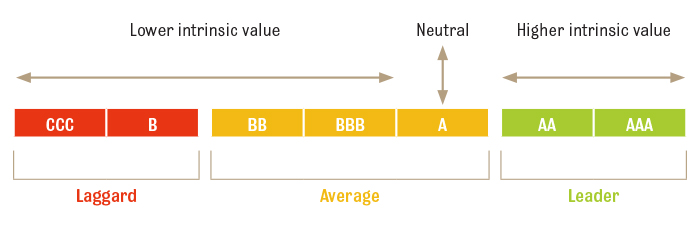

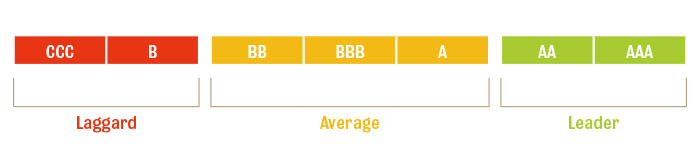

In addition, our models integrate both ESG risks and opportunities (in terms of the cost of capital): hence, a company with a “leader” ESG profile (see the schema below) will be assigned a higher intrinsic value, whereas a “laggard” company (see the schema below) on ESG issues will be assigned a lower intrinsic value. The incorporation of ESG data is based on ESG ratings established by the data supplier MSCI ESG Research 8(AAA to CCC), where a rating of A is considered neutral. As such, companies with a rating of A will not have their valuation model amended.

| MSCI Rating | Ajustement du coût du capital |

|---|---|

| AAA | -0.30% |

| AA | -0.15% |

| A | +0.00% |

| BBB | +0.15% |

| BB | +0.30% |

| B | +0.45% |

| CCC | "+0.60% |

Integrating ESG data into the valuation process, investment decisions and hence final portfolio allocations is fully in line with our fundamental approach of selecting securities issued by high-quality companies through a long-term entrepreneurial approach. Taking non-financial data into account paints an even more detailed picture of all risks and opportunities associated with candidates for investment and therefore enables us to take even more well-informed investment decisions.

5.2. External investment funds

In-depth qualitative analysis is carried out to assess the solidity of the management process, and the environmental, social and governance (ESG) approach of the investment funds in our universe in particular. To that end, various approaches may co-exist:

- the best-in-class approach, which seeks to select companies with the best environmental, social and governance practices in their sector or industry;

- the ESG integration approach, which places equal emphasis on financial and non-financial criteria;

- the thematic approach, which targets a specific area, such as the environment, water management or gender parity;

- impact investing, which aims to generate a positive environmental or social impact. The key features of impact investing are its intentionality and the measurability of the impact.

In addition to qualitative analysis of funds’ management processes, our fund selection team tries to determine whether the management company itself also behaves in a thoughtful, sustainable way. To that end, our analysts have put together a questionnaire that allows them to understand the extent to which the management company under review has weighed up sustainability risks and opportunities. This questionnaire serves as a point of reference when identifying the management company’s positioning on sustainable investment, its philosophy and the concrete measures it has implemented.

Our system also includes a quantitative element, which means that it relies on external ratings of the various vehicles. To do so, we use MSCI ESG scores, which rate the various funds according to ESG risk on a scale of 1 to 109.

6. Integrating principal adverse impacts

6.1. Methodology for evaluation

The SFDR requires the Bank to report the principal adverse impacts of its investments in products that are subject to this Regulation.

The 18 indicators relating to the principal adverse impacts identified by the regulator, which must be taken into account systematically, are the following:

- total GHG emissions

- carbon footprint

- GHG intensity of investee companies

- exposure to companies active in the fossil fuel sector

- share of non-renewable energy consumption and production

- energy consumption intensity per high impact climate sector

- activities negatively affecting biodiversity-sensitive areas

- emissions to water

- hazardous waste and radioactive waste ratio

- violations of UN Global Compact principles and Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises

- lack of processes and compliance mechanisms to monitor compliance with UN Global Compact principles and OECD Guidelines for Multinational Enterprises

- unadjusted gender pay gap

- board gender diversity

- exposure to controversial weapons (anti-personnel mines, cluster munitions, chemical weapons and biological weapons)

- GHG intensity (for states)

- investee countries subject to social violations

- exposure to fossil fuels through real estate assets

- exposure to energy-inefficient real estate assets

For each asset class, and each of the indicators set out above, a threshold set by the Bank determines whether or not an asset is consistent with the Bank’s ambitions in terms of principal adverse impacts. This threshold may be either fixed (for instance according to EU recommendations) or variable, according to a regional average of indicators for similar assets.

We have divided these indicators into four categories covering the following issues:

- the climate and the environment (e.g. greenhouse gas emissions, exposure to companies active in the fossil fuel sector, etc.);

- waste production and the use of water resources (e.g. ratio of hazardous waste and radioactive waste, etc.);

- the United Nations Global Compact (e.g. violations of the United Nations Global Compact and the OECD Guidelines for Multinational Enterprises, etc.);

- social themes and employee rights (e.g. diversity within governance bodies).

For each of these categories, a minimum number of indicators must comply with the thresholds set in order for an investment to be regarded as being consistent with our ambitions to limit adverse impacts in these areas. Accordingly, we ensure that we limit the adverse impacts of our investment decisions when advising our clients concerning investments that are suitable for their sustainability preferences.

We take account of the principal adverse impacts within the context of our discretionary management services for our products that promote ESG characteristics (classified under Article 8 SFDR) or that have a sustainable investment objective (classified under Article 9 SFDR).

A minimum percentage of investments that are consistent with these categories is thus set for each mandate. This approach aims to ensure that the positions held outperform the average for comparable assets, and accordingly that the portfolio as a whole has a more limited adverse impact in ESG terms.

6.2. Due diligence

The Bank has established a system of controls to ensure that good quality data is used in order to present the principal adverse impacts. Accordingly, strict due diligence is carried out on the data used when making decisions in relation to investments.

This control mechanism involves an analysis of the coverage of this data and the definition of minimum coverage thresholds required for the principal adverse impacts to be included in the Bank’s investment decisions. In our view, an asset reporting indicators on a low proportion of its investments does not guarantee sufficient data quality to impact the investment decisions of the product.

7. Sustainable investment

According to the SFDR, an asset defined as a “sustainable investment” must comply with a combination of three criteria:

- Contribute to

- an environmental objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or;

- a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities.

- Do no significant harm (DNSH) to any of these objectives.

- Follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance.

The combination of these criteria results in the establishment of a quantitative test, which is carried out by the Bank for each asset. For some of these investments, a complementary manual, qualitative approach may be established in order to validate certain results.

The following method has been developed in order to establish whether an asset can be regarded as a “sustainable investment”:

In order for an asset to be classified as sustainable, the Bank considers that the share of its revenues that has contributed to one of these 4 themes must be 20% or higher.

- The positive contribution to an environmental and/or social objective is measured through the share of revenues aligned with the Sustainable Development Goals (“SDGs”) defined by the United Nations, as shown on the MSCI ESG Manager platform, which are split across four major themes;

- The establishment of a test for the DNSH criterion, resulting in the consideration of additional data points (“severe” and “very severe” controversies, activities in certain sectors such as controversial weapons, tobacco and coal). An asset with insufficient data coverage (e.g. investment funds with underlyings that are not assessed by MSCI) cannot be considered a sustainable investment.

- The usage of MSCI data associated with the implementation of “good governance” practice, resulting in particular in the exclusion of assets with an MSCE ESG rating of CCC or B. MSCI ESG ratings are intended to measure the capacity of enterprises to manage ESG risks and opportunities associated with their activities and operations. They give an overview of companies’ ability to manage resources, including human capital, sustainably, to guarantee operational integrity on the basis of sound management practices, and to comply with relevant standards including tax legislation. An MSCI ESG rating of BB or higher generally indicates a company’s ability to manage its resources, mitigate principal risks, seize opportunities, and meet basic corporate governance expectations. The use of MSCI ESG ratings as a basic measure of good governance encompasses four aspects of such practices.

The definition of a sustainable asset may vary according to the individual company, the nature of its business, its choice of methods, and the source of data. By opting for alignment with the SDGs, the Bank has taken a deliberately cautious approach, which may result in low percentages of sustainable instruments within a portfolio. While these percentages of sustainable assets may appear conservative, they reflect a prudent methodological approach, which may evolve over time.

8. The EU Taxonomy

Starting from 1 January 2023 (according to the EU Taxonomy on sustainable finance), our products that promote ESG characteristics (classified under Article 8 SFDR) must provide additional information concerning these characteristics, as well as the extent to which they invest in economic activities that are economically sustainable within the meaning of Article 3 of the Taxonomy.

The Taxonomy-alignment of our products’ investments is calculated according to the MSCI methodology, which makes it possible to identify companies that generate revenues from eligible commercial activities “potentially aligned” with the EU Taxonomy for sustainable finance. For the companies concerned, MSCI provides estimates of the revenue percentages associated with environmentally sustainable economic activities. Whilst the Bank thus places a particular focus on its products’ alignment with the Taxonomy, since the currently available proportion of investments aligned with the Taxonomy is very low, the Bank does not regard this factor as a key element within its process for evaluating investment opportunities.

9. Our management solutions

9.1. Discretionary BL Funds mandate

Our management philosophy is built on five principles:

- A long-term approach focused on long-term asset protection and growth;

- An investment strategy drawn up independently in Luxembourg by our managers;

- Only selecting high-quality companies (companies with a tangible competitive advantage, offering high levels of profitability and surplus cash, etc.);

- Paying particularly close attention to valuation levels.

Our portfolios are built based on a long-term strategic allocation that sets the overall framework for the investments by combining different asset classes spread over different geographic regions and economic sectors. The low level of correlation between these asset classes ensures that the portfolio is sufficiently diversified and that risk is managed.

The BL Funds mandate invests mainly in funds managed by BLI, and is classified under Article 8 SFDR. This means that it promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

9.1.1. Selecting companies for the equity funds

We use a resolutely entrepreneurial approach to identify companies that will generate high levels of profitability for many years to come. This long-term perspective, where the aim is to understand the various aspects of a company before investing so as to measure all associated risks, aligns well with our ESG approach.

The investment universe is made up of companies with transparent operations and clear business models.

The ESG investment policy of the Bank and BLI for equity management is built on several separate yet interdependent pillars. In addition to sector policies and analysis of the investment universe detailed above, BLI has also established an active shareholder engagement policy.

As part of its ESG investment policy and voting policy, BLI subscribes to the Institutional Shareholder Services Inc. sustainable voting policy (ISS). This sustainability policy is designed to support shareholder resolutions based on standards that enhance long-term value for shareholders and stakeholders while also aligning the company’s interests with those of the wider society.

BLI also actively endeavours to engage with companies in an effort to improve the transparency of their ESG-related information and adjust their behaviour so as to encourage them to make changes or bring their practices into line with recognised international standards.

9.1.1.1. Monitoring of controversies

Candidates for investment and companies held in the portfolio are subject to constant monitoring to identify noteworthy ESG events that could affect the company’s business model, its reputation and potentially therefore BLI’s investment case. The BLI SRI Committee thus receives daily alerts via MSCI ESG Manager for all notable controversies affecting portfolio companies.

The filter is initially based on the classification of controversies allocated by MSCI based on the degree of severity (minor moderate, severe and very severe). Assets exposed to a very severe controversy must be withdrawn from the BLI investment universe within three months of their change in status10.

Companies exposed to a “severe” controversy undergo in-depth analysis drawing on various sources of information, including internal research, external research, the media and company information (in particular, CSR reports).

On the basis of this proprietary analysis carried out by the SRI Committee, an opinion is formulated concerning the materiality of the dispute for the company’s long-term economic model and the BLI investment thesis. This analysis also constitutes the starting point for identifying opportunities for engagement in order to focus our efforts on opportunities that offer potential for significant change.

Any new controversies are analysed as and when they arise. In any case, the analysis is reviewed twice a year so as to include any relevant new information.

The BLI equity managers receive regular updates concerning the assessment of controversies affecting the companies within their investment universe. These updates are used within the ambit of the voting process and also ensure that this non-financial data is taken into account within the decision making process.

9.1.2. Selecting issuers for the bond funds

Our bond investments focus on bonds from top quality issuers. The portfolio is constructed based on a set of criteria that include:

- assessment of the macroeconomic context;

- the quality of government fundamentals (solvency);

- the portfolio’s sensitivity to interest rate movements.

BLI applies two major approaches within its bond portfolios, either individually or in combination depending on the funds in question:

- ESG optimisation: incorporation of ESG factors and non-financial elements in the analysis and selection process for individual issuers. The aim is for the average ESG score of each component (sovereign bonds and corporate bonds) to be higher than that of an index representing the relevant universe;

- Impact investing: investments made with a view to generating a positive social and/or environmental impact as well as a financial return. Several types of instrument with different characteristics are available:

→ Liquid strategies: Mainly green bonds;

→ Alternative strategies: microfinance, project financing, housing, etc.

9.1.2.1. Selecting sovereign issuers

BLI’s bond fund management team uses publicly available data to assess the ESG profile of the various sovereign issuers before assigning them a fundamental ESG score on a scale of 0 to 10. This public data comes from bodies such as the Food and Agriculture Organization of the United Nations, the International Labour Organization, the Global Health Observatory, etc.

As this data can be between two and ten years old and is not updated regularly, BLI has developed a proprietary methodology for calculating a momentum score in order to reflect the ESG dynamic for the countries analysed. This methodology uses artificial intelligence and language processing technology to filter information flows (news, articles and more).

A score per ESG factor is calculated for each country and then combined to give an overall ESG momentum score (from -2 to +2). This momentum score can push the fundamental ESG score higher or lower.

The bond management team also assesses the impact of the portfolios on the UN SDGs.

9.1.2.2. Selecting corporate issuers

As in the equity component, ESG analysis of corporate issuers is conducted based on ESG scores developed by MSCI. The credit analysis process also places particular emphasis on any major controversies (those with a red flag in the MSCI classification) that could affect the issuers in question, as well as whether or not the company adheres to the principles of the UN Global Compact.

Credit analysis involves comparing ratings based on financial data and ESG ratings to identify high-quality issuers. Where companies’ fundamental characteristics and returns are similar, the management team will prioritise the issuer with a higher ESG rating.

9.1.2.3. Impact investing

As regards green bonds, the selection process seeks to exclude issues rated lower than BB+ and those where the issue amount is under USD 300 million. The next step is to carry out fundamental analysis of financial and sustainability factors. The aim is to ensure that issues actually target environmental and/or social projects.

For microfinance investments, BLI relies on specialist external advisers who recommend eligible issues and conduct ongoing monitoring of the selected investments, while also taking into account the main investment criteria (minimum issue amount, rating, project type, region, etc.).

9.1.3. ESG approach at portfolio level

To supplement the ESG approach used for each of the funds (except funds of funds) that make up the managed portfolio, quantitative analysis is also conducted at portfolio level. We use the MSCI ESG Manager scores (between 0 and 10).

We aim for coverage of at least 75% of the assets (excluding cash and gold) by MSCI ESG Manager in order to ensure that the data is properly representative of the portfolio, and for at least 50% of assets to be defined as “responsible”, i.e. rated at least BBB on the MSCI ESG Manager scale. The proportion (50%) is determined after excluding out-of-scope assets (cash and gold).

On the other hand, over the short term we aim to have a minimum proportion of 5% of sustainable assets, determined with reference to the portfolio investments with sufficient data coverage.

Our aim is for the average portfolio rating to be A or higher, confirming average or above-average ESG positioning. This average rating reflects the weighted sum of MSCI ESG scores for the different investments, which is then converted into a rating between AAA and CCC according to the MSCI ESG Manager scale.

Laggard: a company that is lagging behind its sector due to its high exposure and inability to manage significant ESG risks.

On average: a company with a mixed or standard track record in managing the most significant ESG risks and opportunities relative to its peers.

Leader: a sector-leading company in terms of managing the most significant ESG risks and opportunities.

9.2. Discretionary external funds mandate

Under this form of management, the objective of the mandate is primarily opportunistic. If offers a broad range of external funds and fund managers whose management styles complement our own. Details of the way in which we select external investment funds are provided in section 5.2. of this document.

This type of mandate is classified under Article 8 SFDR. This means that it promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

A quantitative approach is also used at portfolio level. We use the MSCI ESG Manager scores (between 0 and 10).

We aim for data coverage of at least 75% of the assets (excluding cash and gold) by MSCI ESG Manager in order to ensure that the data is properly representative of the portfolio, and for at least 50% of assets to be defined as “responsible”, i.e. rated at least BBB on the MSCI ESG Manager scale. The proportion (50%) is determined after excluding out-of-scope assets (cash and gold).

On the other hand, over the short term we aim to have a minimum proportion of 5% of sustainable assets, determined with reference to the portfolio investments with sufficient data coverage.

Our aim is for the average portfolio rating to be A or higher, confirming above-average ESG positioning. This average rating reflects the weighted sum of MSCI ESG scores for the different funds, which is then converted into a rating between AAA and CCC according to the MSCI ESG Manager scale.

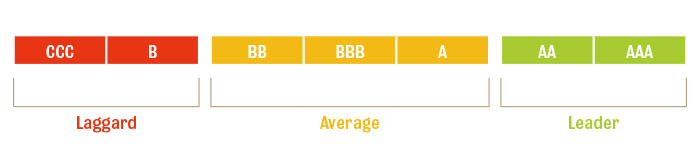

Laggard: a company that is lagging behind its sector due to its high exposure and inability to manage significant ESG risks.

On average: a company with a mixed or standard track record in managing the most significant ESG risks and opportunities relative to its peers.

Leader: a sector-leading company in terms of managing the most significant ESG risks and opportunities.

9.3. Discretionary socially responsible funds mandate

9.3.1. Selection of external investment funds

Discretionary socially responsible funds mandates invest in funds and trackers with embedded ESG investment strategies. Details of the way in which we select external investment funds are provided in section 4.2. of this document.

This type of mandate is classified under Article 8 SFDR (Regulation (EU) 2019/2088). This means that it promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

9.3.2. ESG approach at portfolio level

To supplement the ESG approach used for each of the funds that make up the managed portfolio, quantitative analysis is also conducted at portfolio level. We use the MSCI ESG Manager scores (between 0 and 10).

We aim for data coverage of at least 90% of the assets (excluding cash and gold) by MSCI ESG Manager in order to ensure that the data is properly representative of the portfolio, and for at least 75% of assets to be defined as “responsible”, i.e. rated at least BBB on the MSCI ESG Manager scale, this proportion (75%) being determined after excluding out-of-scope assets (cash and gold).

In addition, no asset with a score of CCC may be held in the mandate.

On the other hand we aim to have a minimum proportion of 20% of sustainable investments, determined with reference to the portfolio investments with sufficient data coverage.

In addition, our aim is for the average portfolio rating to be AA or higher, confirming above-average ESG positioning. This average rating reflects the weighted sum of MSCI ESG scores for the different funds, which is then converted into a rating between AAA and CCC according to the MSCI ESG Manager scale.

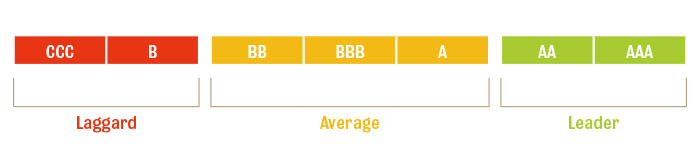

Laggard: a company that is lagging behind its sector due to its high exposure and inability to manage significant ESG risks.

On average: a company with a mixed or standard track record in managing the most significant ESG risks and opportunities relative to its peers.

Leader: a sector-leading company in terms of managing the most significant ESG risks and opportunities.

9.4. Direct lines mandate

The discretionary direct lines mandate is built on two fundamental principles:

- We use a resolutely entrepreneurial approach to identify companies that will generate high levels of profitability for many years to come. This long-term perspective, where the aim is to understand the various aspects of a company before investing so as to measure all associated risks, aligns very well with an ESG approach.

- The investment universe is made up of companies with transparent operations and clear business models. Our stock-picking methodology also relies on company valuation levels, since it is the price paid that determines the future return on any investment.

- Diversification (across asset classes, sectors and geographical regions): the portfolio construction process entails combining decorrelated asset classes, so that the total portfolio risk is lower than the sum of the risks of the various assets (or instruments) within it. This serves to minimise the risk per unit of return or maximise the return per unit of risk. We also focus on the relative valuation levels of the various asset classes.

- Selecting high-quality securities:

This type of mandate is classified under Article 8 SFDR. This means that it promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

9.4.1. Equities

The ESG investment policy for the equity component is built on several separate yet interdependent key principles. In addition to sector policies, monitoring of controversies, fundamental analysis considers the ESG risks and opportunities under valuation model via the discount rate: hence, a company with a “leader” ESG profile (see section 5.1) will be assigned a higher intrinsic value, whereas a “laggard” company (see section 5.1) on ESG issues will be assigned a lower intrinsic value. The incorporation of ESG data is based on ESG ratings established by the data supplier MSCI ESG Research (AAA to CCC), where a rating of A is considered neutral. As such, companies with a rating of A will not have their valuation model amended.

Integrating ESG data into the valuation process, investment decisions and hence final portfolio allocations is in keeping with our fundamental approach of selecting securities issued by high-quality companies. Taking non-financial data into account paints a detailed picture of all risks and opportunities associated with candidates for investment and therefore enables us to take investment decisions that are aligned with the Bank’s sustainability ambitions.

9.4.2. Bonds

ESG factors are also taken into account in the analysis and selection process for individual issuers. As in the equity component, ESG analysis of corporate issuers is conducted based on ESG scores developed by MSCI.

Credit analysis involves comparing ratings based on financial data and ESG ratings to identify high-quality issuers. Where companies’ fundamental characteristics and returns are similar, the management team will prioritise the issuer with a higher ESG rating.

9.4.3. ESG approach at portfolio level

To supplement the ESG approach used for each of the instruments/assets that make up the managed portfolio, quantitative analysis is also conducted at portfolio level. We use the MSCI ESG Manager scores (between 0 and 10).

To ensure that the data is properly representative of the portfolio, we aim for coverage of at least 75% of the assets (excluding cash and gold) by MSCI ESG Manager.

We also aim for at least 50% of “responsible” assets, i.e. rated at least BBB on the MSCI ESG Manager scale, this proportion (50%) being determined after excluding out-of-scope assets (cash and gold).

On the other hand, over the short term we aim to have a minimum proportion of 5% of sustainable assets, determined with reference to the portfolio investments with sufficient data coverage.

Our aim is for the average portfolio rating to be A or higher, confirming average or above-average ESG positioning. This average rating reflects the weighted sum of MSCI ESG scores for the different assets, which is then converted into a rating between AAA and CCC according to the MSCI ESG Manager scale.

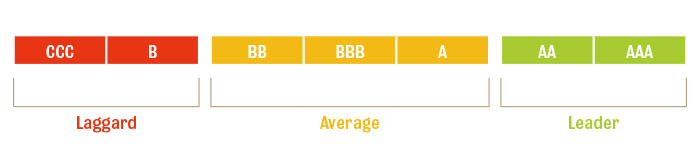

Laggard: a company that is lagging behind its sector due to its high exposure and inability to manage significant ESG risks.

On average: a company with a mixed or standard track record in managing the most significant ESG risks and opportunities relative to its peers.

Leader: a sector-leading company in terms of managing the most significant ESG risks and opportunities.

9.5. BL-Global funds management solution

In addition to the policies described above for BL Funds mandates, a best-in-class approach is preferred when investing in gold stocks. In this way, we ensure a certain level of ESG performance, which implies a positive and progressive approach to sustainability issues on the part of the companies under consideration and requires compliance with certain sustainability standards. In practice, for a company to be included in our portfolios it must meet at least the following two criteria:

- compliance with the UN Global Compact companies must pass the UN Global Compact compliance check conducted by MSCI. BLI will engage in a dialogue with the companies on the watch list, and the outcome of this dialogue must be published and of a satisfactory quality;

- Only companies with a minimum MSCI ESG rating of BBB are eligible for investment.

This type of mandate is classified under Article 8 SFDR. This means that it promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

9.6. Customised discretionary management

Customised discretionary management identifies investments in accordance with the investment strategy agreed upon with the client. The management objectives as well as the degree of risk depend on the investor profile established, which may also be obtained where appropriate from the sustainability preferences provided by the client. This enables investments to be adapted in line with the client’s knowledge and experience, financial situation, investment objectives and sustainability preferences. In order to do so, managers may refer to the universe of recommended investment vehicles.

This type of mandate is classified under Article 6 SFDR.

9.7. Advisory management

The investment advisory service largely draws on our universe of investment vehicles. These vehicles are being gradually classified using a sustainability scale with a view to achieving complete coverage of our universe, in order to make recommendations that take ESG risks into account.

Specifically, individual securities are selected on the basis of the Bank’s fundamental approach and non-financial data is considered when assessing risks and opportunities. In addition, assets that are subject to an exclusion policy or a “very severe” controversy (according to the MSCI ESG Manager classification) are excluded from the universe of products recommended by the Bank.

In accordance with the Regulation on the integration of ESG data into MiFID II11, the sustainability preferences provided by clients are used to complete their respective investor profiles, determined on the basis of management objectives and the degree of risk. This data thus make it possible to provide advice to the client that is consistent with their investor profile and ESG preferences.

Advice is adjusted in line with ESG preferences based on:

- the impact of the transactions envisaged on the global MSCI score of the client’s portfolio investments;

- the proportion within the portfolio of assets that are regarded as “responsible” and those that are regarded as sustainable; and finally

- compliance with any preferences in terms of principal adverse impacts indicated by the client.

If the transactions are not considered to be suitable for the client's investment profile or ESG preferences, the Bank shall inform the client of this.

If the unsuitability results exclusively from the ESG preferences indicated by the client, these transactions may still be executed if so requested by the client, under their sole responsibility.

Annex: Glossary

Controversies: significant events liable to affect the company’s business model, its reputation and potentially therefore the investment case.

Engagement: active, long-term dialogue between investors and companies concerning ESG factors

Exclusion: an exclusion entails a prohibition on investment in the securities of a company on account of commercial activities that are deemed to be unethical, detrimental to society or in breach of laws or regulations.

ESG or sustainability factors: environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters.

Article 6 investment fund under the SFDR: an investment fund that does not specifically promote environmental and/or social characteristics.

Article 8 investment fund under the SFDR: an investment fund that promotes, among other characteristics, environmental or social characteristics, or a combination thereof, providing that the companies in which investments are made apply good governance practices.

Governance: the body of rules, practices and processes according to which a company is governed and its management is supervised.

Integrating ESG data structural integration of information concerning ESG factors into the decision-making process.

Impact investing: sustainable investments the main objective of which is to achieve a positive and tangible effect on society or the environment. This social or environmental impact is claimed and has as much importance as the financial return. It involves a transparent methodology, which enables the investor to measure and appreciate the beneficial effects announced.

Sustainable investment: an investment in an economic activity that contributes to an environmental or social objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance.

Socially Responsible Investment (SRI): an investment regarded by the Bank as responsible where it takes into account, in addition to traditional financial criteria, non-financial environmental, social and/or governance (ESG) aspects.

These investments seek to reconcile return (financial performance) and sustainable development (definition below) by promoting best practices in terms of respect for the environment, society and governance.

UN Sustainable Development Goals (SDGs): this is a reference framework for supporting sustainable development, formulated by the UN in 2015 in the form of 17 priorities as part of its 2030 Agenda with the goal of promoting prosperity whilst protecting the planet.

This is the framework to which financial products refer where they assert that they are pursuing or contributing to a sustainable objective, such as eradicating poverty, ending hunger, ensuring the good health and well-being for populations and workers, etc.

Green bonds: debt securities the aim of which is to finance exclusively environmental projects.

Sector policies: principles and rules established for the purpose of excluding or reducing investments and financing within particular sectors (coal, weapons, etc.)

Sustainability risk or ESG risk: an environmental, social or governance (ESG) event or condition that, if it occurs, could cause a material negative impact on the value of the investment, irrespective of whether that impact is actual or potential.

Regulation on the integration of sustainability factors into MiFID II: Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms.

SFDR (Sustainable Finance Disclosure Regulation): Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector. This European Directive aims to ensure greater transparency regarding environmental or social responsibility within financial markets, notably by requiring the disclosure of sustainability information for financial products.

The EU Taxonomy Regulation: Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment and amending Regulation (EU) 2019/2088. The European taxonomy is a classification system that aims to establish which economic activities can be considered environmentally sustainable. The Taxonomy Regulation creates a standard language for companies and investors. Economic activities must comply with certain sustainability criteria in order to be considered sustainable under the EU Taxonomy Regulation.

1Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector, hereinafter the “SFDR”.

2Our commitment policy is available at www.banquedeluxembourg.bank

3MSCI is a financial data provider selected by the Bank. ESG Manager is a module dedicated to ESG data, which is used by the Bank in relation to its management and advisory activities.

5(except external funds in which we invest under the terms of specific mandates).

6Except precious metals, alternative funds and other assets the sustainability of which is difficult to assess.

7 8See the MSCI ESG ratings methodology www.msci.com

9See the details of the ESG rating methodology for funds at www.msci.com

10However, the relevant fund manager does have the option to submit a request to the SRI Committee explaining the reasons why he or she believes that the company should still be eligible for investment. Approval can be granted by means of a vote with a simple majority. The fund manager does not have the right to cast a vote.

11Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms.